Keller Group plc (“Keller” or “the group”), the world’s largest geotechnical contractor, announces its results for the six months ended 30 June 2018.

H1 2018 summary:

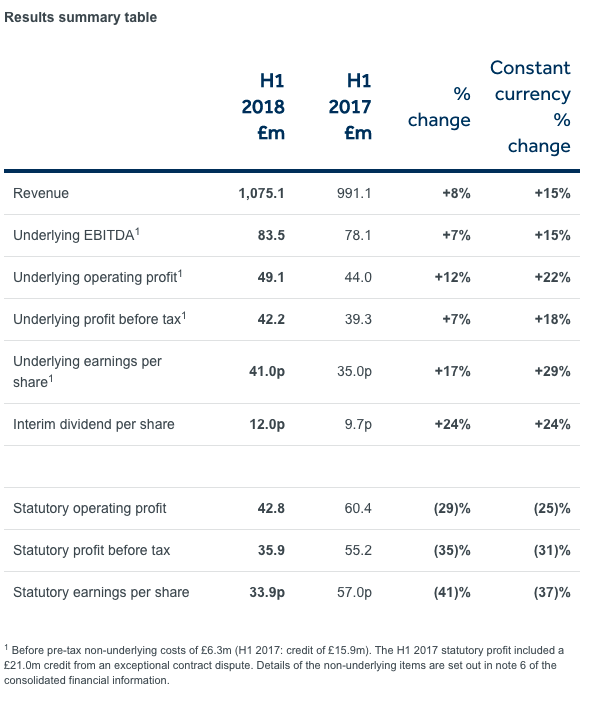

- Record first half revenue of £1,075m driven by constant currency growth of 15%

- Strong underlying constant currency operating profit growth of 22%

- Divisional performance

- North America: strong growth in both revenue and profit, despite poor weather in the first quarter

- EMEA: solid performance with profits maintained despite less revenue from large projects and a harsh winter

- APAC: losses substantially reduced; profitable second quarter and an encouraging order book

- Tendering activity remains positive and the order book remains healthy – up 1% excluding the Caspian project, giving confidence for the full year

- Net debt increased to £367m, representing 1.9x annualised EBITDA, due to the More trench acquisition, strong organic growth and normal seasonal working capital outflows – currently expected to be around 1.5x at year end

- Underlying earnings per share increased 17% to 41.0p

- Interim dividend per share of 12.0p, up 24%, following the upward rebasing of the 2017 full year dividend

Alain Michaelis, Chief Executive, said:

“We remain encouraged by the group’s progress. Despite a harsh northern hemisphere winter, we are reporting a strong financial performance for the first half of the year. Broadly healthy markets, consistent operational delivery and business improvement projects have all contributed to this performance. We remain well positioned to benefit from the global trends of urbanisation and infrastructure growth and we continue to advance our strategic objectives. We are confident of making further progress in the second half.”

Notes to Editors:

Keller is the world’s largest geotechnical contractor, providing technically advanced geotechnical solutions to the construction industry. With annual revenue of more than £2.0bn, Keller has approximately 11,000 staff world-wide.

Keller is the clear market leader in the US, Canada, Australia and South Africa; it has prime positions in most established European markets and a strong profile in many developing markets.